As a small business owner you are very aware of just how little time there seems to be each workday. Running a business isn’t easy, and requires a real investment of time and energy. Business owners can find themselves putting out fires or dedicating time to more pressing problems. Accounting, finance, and bookkeeping are activities that get sacrificed as a result of this pull. And often, even if an owner sets aside time to go over reports, they can fail to understand them. Even if they understand them, owners often fail to make the best use of the information provided. Most business owners, after all, aren’t financial experts, and reports can be dense and difficult to appreciate.

That doesn’t mean that financial reports are something owners can afford to simply ignore. Reports detail things like cash flow, and are vitally important when it comes to planning for future growth. Owners can’t afford to ignore financial statements, regardless of how unapproachable they may seem. Approximately 82% of businesses fail due to cash flow issues. Think of how many of those owners could have adjusted if they knew the issues that lie ahead.

Traditional Bookkeeping Isn’t the Answer

While hiring a traditional bookkeeper may seem like the solution, I want to describe to you why it isn’t. Many traditional bookkeepers are very skilled at reporting numbers. They can help business owners with necessary tasks like paying bills, dealing with collections and keeping payroll up to date. But that is where the skills of a traditional bookkeeper stop. They often lack the knowledge and ability to interpret data or create sound financial plans. Owners who rely solely on traditional bookkeeping services will still fail to fully utilize financial data. These owners will most likely face the problems that arise from poor financial planning.

At Krieger Analytics, we like to use the term “Enhanced Bookkeeping”. Enhanced bookkeeping is an affordable solution that solves these problems, and it is one that business owners should consider. In this article, we will define enhanced bookkeeping. We will discuss in detail how it can be combined with a traditional approach to address the lack of financial strategy and data interpretation today’s current small business owners face.

What is enhanced bookkeeping?

Put simply, enhanced bookkeeping is a more complete solution. It is an approach that emphasizes the interpretation of financial reports and strategy instead of the simple collection of data. Enhanced bookkeeping is a way that business owners use finance and accounting to plan for the financial future of their business. It is the combination of a part-time CFO or virtual CFO and traditional bookkeeping to their accounting services.

How, does enhanced bookkeeping help business owners?

Enhanced bookkeeping may seem like a simple concept, but like other financial topics, it can also be difficult to fully understand. Below is a more in-depth explanation of the 2 main ways that enhanced bookkeeping services will make small business owners’ lives easier.

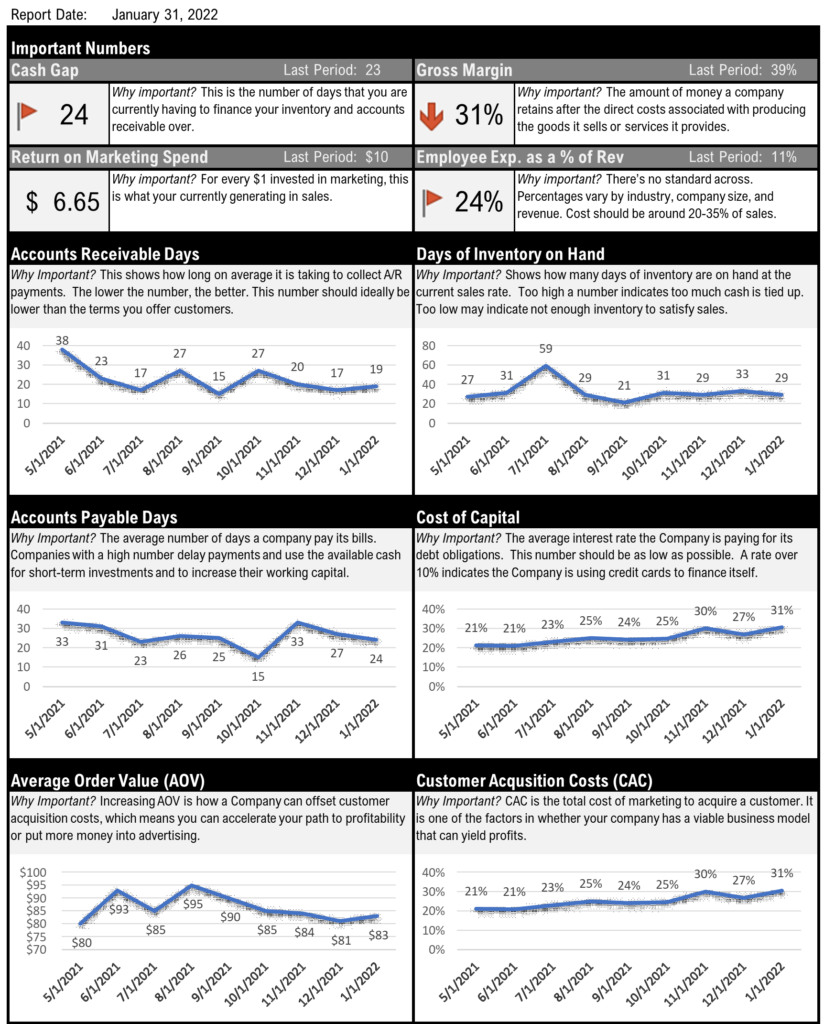

Enhanced bookkeeping makes use of KPIs and scorecards

If you don’t know what key performance indicators (KPIs) or dashboards are, not to worry. You can find a quick primer here.

Essentially, KPIs are a way for business owners to more readily and easily understand the most important financial data about their businesses. They help to cut through the huge tangle of data and numbers that describes the finances of a business and present owners with easily digestible, actionable metrics. These metrics will form the cornerstone of a business’ financial strategy. Think of them like the solid foundation of a building.

So, you may be thinking, “That sounds great; let me just whip up a few KPIs and start reaping the benefits.”. Like other financial concepts, though, KPIs aren’t useful unless carefully considered. This is where adding the strategy and thoughtfulness of a virtual CFO to traditional bookkeeping can become more powerful. An outsourced CFO will help create KPIs that measure the right things, are carefully and frequently reviewed, and build toward an overall strategic financial plan.

Enhanced bookkeeping makes use of the expertise of a CFO or virtual CFO

A financial expert is a key to upgrading your bookkeeping services. A virtual CFO is like the quarterback of an accounting team. He or she coordinates the other players, calls the play, and is in control of how financial action develops. A CFO is the member of the team charged with developing financial goals and plans, which are vitally important to the success of a business. Without them, business owners are flying blind, and often surprised by future scenarios they failed to consider or plan for.

A quick example..

Think, for instance, of a food manufacturing business whose owner aims to make $100,000 in profit in the next fiscal year. That owner cares a lot about their business and works hard to ensure it succeeds. But they aren’t a financial expert. They probably don’t know if $100,000 in profit is a reasonable goal, or what objectives they need to prioritize in order to meet that goal. These things are the realm of a CFO, who is an expert at defining and planning to meet financial goals.

How might an outsourced CFO help in this specific situation? First, a CFO would help by putting a strategic process in place that would set measurable, short term goals. These goals would be tracked by KPIs that were developed. The CFO would take lead in developing a system to collect the data needed for these KPIs. To make sure things were on track, the CFO would develop a dashboard to track these KPIs. As the process moved along, the CFO would have a model where they could show the owner the impact of certain decisions. This way the small business owner can make decisions with the knowledge in mind of what impact they may have.

How much is enhanced bookkeeping?

A lot of small business owners get to this point and think, “Sounds great, probably costs too much”. Bookkeeping and accounting services prices are skyrocketing in 2021 and will continue in 2022. It’s not uncommon for small business owners to have to be quoted prices in the thousands just for bookkeeping. That is, if a small business owner can find a bookkeeper who is actually looking for work.

On the flip side, bookkeepers are notorious for not having systems that allow them to scale with their clients. Bookkeepers often go into each client with a “I can do anything they need” type of approach. While this might sound like great customer service, it often leads to increased fees or a decrease in service level due to a lack of vision about what services a client actually needs.

When a business owner is reviewing options, they should ask a potential service provider what services they believe their business needs. This approach will lead the owner to discover if the service provider has a plan and strategy to work with small businesses.

Thats great! So how much does it cost?

So how much should a setup like this cost? At Krieger Analytics, our most popular service plans cost between $1600-$2600 per month. For a business that generates between $1 million and $2 million in revenue, it should be looking to spend 1.5-3% of revenue each year on accounting services. This is an all-encompassing number including tax preparation, bookkeeping, and virtual CFO services. As revenue drops below this range, it is not uncommon to spend between 3-5% of revenue on these services.

Your next steps

So, you may be thinking that enhanced bookkeeping sounds important for your business. But you shouldn’t discount the importance of traditional bookkeeping either. The precise and error-free reporting of financial data, is still a vital part of running a successful business. A good strategy is a balanced one, where you don’t forgo either the accurate reporting of numbers or the interpretation of those numbers and the creation of a broad financial strategy.

Consider, when deciding which mix of these services is right for you, consulting with a CFO or virtual CFO. These financial professionals have the experience to guide your accounting services strategy. Your next step is to identify firms that understand this and have a discussion with them.

Articles in This Series

We’ve put together a whole series of articles like this. Are you interested in learning more about why traditional bookkeeping doesn’t work? Are you ready to join the hundreds of thousands of other owners that are getting more out of their accounting services? Keep reading. Here are links to our other articles.

· Traditional Bookkeeping Doesn’t Work Today

· Why Bookkeeping Fails: Your Current Reporting Can Be Better

· Why Bookkeeping Fails:Forecasting – The Future Is More Important Than the Past

· Why Bookkeeping Fails: Enhanced Bookkeeping is the Future

How Krieger Analytics can help

By now, you know the basics of enhanced bookkeeping. Led by a CFO or virtual CFO, enhanced bookkeeping services will help gear your bookkeeping toward the future. It can make it easier to create an overall financial strategy for growth. In short, your bookkeeping can be smarter, and can help you make crucial decisions for your business.

When most business owners hear this their first reaction is “sure, but at what cost?”. There are two ways to respond to these questions. First, the cost isn’t much more significant. Its not about doing your bookkeeping differently — it is about adding an element that your bookkeeping has been missing. Its about adding the “brains” to your bookkeeping — forecasting, strategy, and analysis. Most business owners would be surprised that this can be accomplished for just a few thousand more each year.

Here is the second way to answer the questions – it’s at the cost of your business. Your competitors are doing this (at least the ones who are growing). The “big boys” who seem to have endless budgets are doing this. How can you afford not to? How can you afford not to have strategic goals and financial insight into your business?

Krieger Analytics specializes in outsourcing accounting services for small businesses. From bookkeeping to virtual CFO and controller consultations, and our background in entrepreneurship and finance means we know what running a business entails. Our goal is to meet your accounting needs without burdening you with the costs of a full-time accounting staff. And, we understand your position as a small business owner, because we have experience running businesses ourselves.

Have questions about anything discussed in this article? Interested in what valuable insights a CFO and business owner has for your business? Conversations are free, so don’t hesitate to reach out at [email protected], and let us explain how our services could be the right fit for you.

Pingback: Traditional Bookkeeping Doesn’t Work Today - K-Analytics

Pingback: Top CPA Says Financial Forecast Accuracy is More Important