Cash Flow Analysis

I’m going to let you in on an secret. Most small businesses fail because they run out of money. That’s insightful! There are many reasons small businesses run out of money: poor business models, inadequate funding, competition, improper planning, poor leadership, and many (many) more. However, all of these issues end with the same result; there is not enough money to keep the lights on.

Many small business failures could be, at the very least, delayed and in many cases, avoided if cash had just been better managed. Enter the concept of the cash conversion cycle. The cash conversion cycle (CCC) is a metric that expresses the time in days it takes for a company to convert its investments in inventory and other resources into cash flows from sales. Seven years ago, I heard a story from Jim Moetz, who had just bought a window company. While Jim had a great business, he was running out of cash and couldn’t figure out why.

Case Study: JM & Company Windows

JM & Company Windows

Jim Moetz had been installing windows since he was 14 years old. His family had owned a local window store in Cheyenne, WY. When Jim turned 18, he went to college at the University of Northern Colorado in Greeley, CO. After college, he took a job with a regional bank in Fort Collins, CO where after 8 years, he had worked his way up to be a Vice President in the Agricultural Lending Department. Jim was never fully satisfied with his career and longed to own a business. He often found himself staying up late at night looking at internet listings of businesses for sale.

One late night in, Jim stumbled upon a local window sales and installation business for sale. Since Jim’s family had a long history in a similar business, Jim reached out to get more information. Five months later, he completed his purchased and subsequently renamed the company, JM & Company Windows.

Upon purchasing the business, Jim knew from his experience at the bank that the Company must have adequate working capital. As a result, Jim had secured a line of credit for $65,000 and put into the bank $25,000 of his own money. The first two months of business were brisk. The Company did better than Jim had expected due to several factors; the main one being he had signed a license agreement with a national distributor to exclusively sell their windows in a territory of northern Colorado. The national distributor advertised on Jim’s behalf as well as provided a discount on purchases in exchange for a royalty fee, due 30 days after month end.

Jim had grown up in banking and understood the importance of establishing good relationships with your vendors. He had established a wonderful relationship with his landlord whom he extended his lease with shortly after purchasing the business. The supplier Jim held a license with required payment within 30 days of receiving the product, however, Jim took great pride in always paying within 5-10 days receipt of the invoice.

Jim had a small staff that worked for him, with one person in a sales role and two “crews” who installed the windows. Jim spent his time between the office, with his crews, and doing sales himself. A typical job would average around $15,000. His markup was 50% of his materials cost. A customer would be invoiced after the job with the payment being due within 10 days of completion of the job. This was somewhat unique; however, it was the policy he had inherited and wished to continue.

Because of the overall price of the projects, JM & Company Windows had a financing arrangement in place with a national financing company that they could offer their customers. This allowed the Company to offer financing to customers so that the payment for the windows could be stretched out over 3 to 5 years. Upon putting a financing agreement in place, the Company would receive payment from the financing company within 30 days for 97.5% of the total cost of the job. Almost 75% of Jim’s customers took advantage of this financing.

The August Crunch

JM & Company Windows had a banner first 2 months under Jim’s ownership. The Company had increased sales by 14% in June and 16% in July over the previous year. However, despite the increase in sales, Jim found that the Company struggled to keep up with its bills and faced a cash shortfall in August.

Jim reviewed his bank reconciliation and balance sheet which both confirmed what the online bank balance was showing. The Company was on the verge of running out of money. This was despite orders for August showing a 7% increase over the previous year’s August.

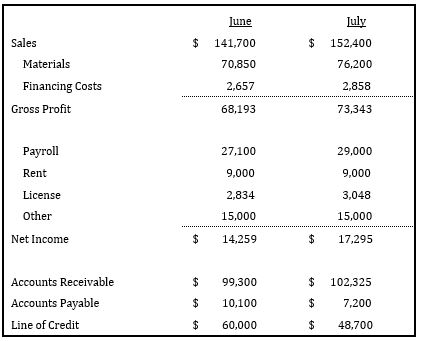

JM & Company Window’s cash crunch is not unique and quite frankly, somewhat common, especially with new small business owners. To further explain the problem, let’s first take a deeper dive into some of Jim’s numbers. As an accountant, numbers tell me a story. Below is a summarized version of Jim’s financial statements.

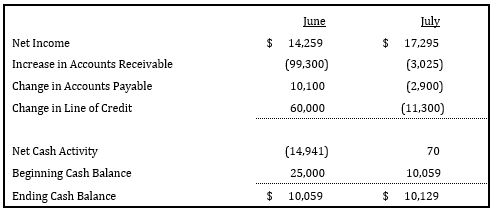

As you can see from above, JM & Company had a very profitable two months. A lot of companies would be very envious of a net profit margin that is greater than 10% each month. However, if we look at the abbreviated cash flow statement, we’ll see a different story:

JM & Company’s big June was actually a cash flow nightmare! Just to make it through the month, Jim had to draw $60,000 on his credit line and his initial working capital of $25,000 was cut by almost 60% to $10,059. How does this make sense when his company showed a net income of $14,259 for June?

What JM & Company realized was they are not managing their cash conversion cycle. If they had an experienced advisor or a outsourced CFO, they would have made changes to how they were operating. Two quick changes would have completely altered the cash flow picture –

- The Company could have offered its customers a 5% discount if they didn’t finance. Further, they should have demanded payment once the job was done rather than invoice their customers.

- The Company should have waited the entire 30 days to pay their materials invoice instead of paying them so quickly.

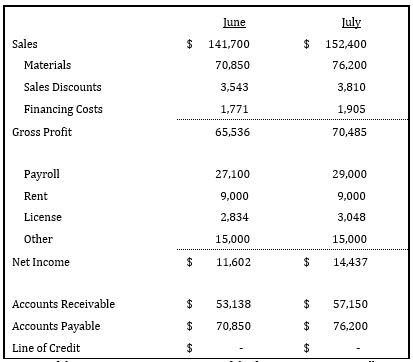

That’s it! Those two changes would dramatically improve their cash flow issues. There are some other minor changes such as when they were paying their rent and licensing fees. They also needed to start pricing in the interest they paid on the line of credit into their pricing. What would those two initial changes do to the Company’s cash flow? Let’s assume that 50% of customers would have taken advantage of the discount. Here is what the newly updated income statement and a few of the balance sheet account would have looked like:

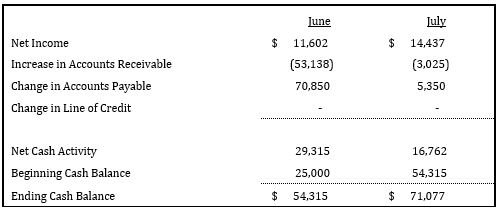

From a review of the new income statement, one of the first items someone will point out is the decrease in net income. While both months still look strong, net income is now less than 10% of sales. However, the big story is on the balance sheet accounts. We see a dramatic decrease in accounts receivable and a big increase in accounts payable. Most importantly, however, in this scenario, Jim has not had to draw on his line of credit. How can that be? Let’s take a look at the statement of cash flow.

Here is where we see a huge change. By collecting sales faster and pushing out their accounts payable the Company was able to improve their cash flow dramatically. Their total cash balance for June increased by over $44,000 and for July by over $61,000. That small decrease in net income can be handled through various pricing strategies.

Cash is King

All the talk on Wall Street and in the popular business press is about earnings. Logically, this seems to make sense. Earnings are often the easiest way to translate into owner value. However, there is a reason there is a saying “cash is king”. Cash creates capital which gives owners of small business the ability to grow through investment and acquisition. With this sort of cash flow, Jim would be able to go out and buy a second window business or hire another crew. Jim is now effective in using the “float” that his company has created. But where do the math and philosophies behind these strategies that JM & Company should have implemented from the beginning come from?

The cash conversion cycle is a powerful tool that should be in every business owners toolkit. While the formula is straight forward and simple to understand, it is the strategies that can be implemented when you analyze your cash conversions that the true power lies.

Accounting can often be thought of only as a way of keeping track of various data. True financial advisors that can look at these data points and help small business owners, are able to translate the cash conversion cycle into real results.