Over the past six months, most of my clients have had to re-evaluate their e-commerce strategy. When I say “re-evaluate,” I being am kind to a few. Many are having to come up with a strategy on the fly. Due to COVID-19, e-commerce is booming more than ever.

The American consumer has only slightly decreased their spending the past 9 months. Consumers have reallocated a large portion of their budget to online spending. While COVID-19 will fade away one day, this trend is most likely here to stay.

Experienced retailers have long had a detailed e-commerce strategy. However, for many of my manufacturing clients, some e-commerce sales channels are relatively new. Even for clients that have long been integrated into e-commerce channels, pricing and costing remain challenges.

In this article, we’re going to look at the economics of selling on Amazon. For some of my manufacturing clients (whether it be a food product, animal products, or consumer goods), I strongly recommend looking into Amazon before making too much of an investment into their own e-commerce platform.

This article will not go into the different marketing and product placement strategies with Amazon. There are books many pages long that go into those topics. My goal is to give a quick, easy to understand guide on the economic factors that go into building a sales channel on Amazon. If this is a channel your business decides to head, I strongly recommend consulting with someone with strong accounting/finance skills on your pricing.

Amazon brings a few significant advantages. First and foremost, their platform is already built. There is no need for a company to build out its website, develop an SEO strategy, investigate online advertising, or any of the other countless tasks. Amazon has done all of that for you. It takes only minutes to sign up and a few more minutes to get product listings on their site.

Second, Amazon boasts over 600 million regular shoppers. Odds are, at least a few of them are already looking for the products a business sells.

There are some pitfalls as well. A business needs to have a clear understanding of what it takes to have a realistic chance of success on Amazon.

A business must be able to differentiate its product in a meaningful way. This is why for manufacturers Amazon presents an excellent opportunity. A retailer trying to sell a brand of shoes on Amazon will struggle unless they have preferred pricing from the manufacturer. The reason being, they are competing with ten other retailers trying to sell the same brand of shoes. It becomes a race to the bottom for pricing. I have seen this specific shoe example first hand.

Selling on Amazon doesn’t have to be an all or nothing decision. Many brands will dabble into Amazon by only offering a few SKUs. For businesses that are worried about channel conflict, this can be a good jumping-off point. Further, starting slow is an excellent way to gauge the impact on a business. While it is great if a product sales jump, a company must gauge the impact on customer service, shipping, and other areas of the company.

We will first walk through the different business models and how this impacts the overall economics. We’ll then walk through the unit-level economic considerations a business must review.

Amazon Business Models

Non Exclusive Sourcing

Many sellers on Amazon are selling products that are readily available from multiple different competitors. In these instances, unless a company enjoys a significant pricing advantage, this is an unsustainable model.

Let’s review my shoe example from earlier. The Perfect Shoe obtained shoes from several different manufacturers. Along with selling them in their retail store, certain agreements also allowed them to sell the shoes on Amazon. However, these agreements also allowed other vendors from across the country to do the same. From the consumer’s perspective, service didn’t matter. They were paying Amazon for shoes, and they want the best price. Whichever vendor offered it would win the sale.

The scenario described above is a race to the bottom. Often these businesses are making little, no, or even negative profit (sometimes while not realizing it).

Exclusive Sourcing

Many manufacturers fall into the category of exclusive sourcing. Since they are manufacturing the product, they enjoy access to the best pricing.

In an exclusive sourcing relationship, a business has been able to secure pricing that allows it not to have to compete with other sellers. Often the product may be unique or proprietary as well, which can also help fuel sales.

This doesn’t mean there is no competition. There undoubtedly will be similar products. Further, other people can still sell the product (Amazon does little to remove unauthorized sellers). Never the less, these businesses do enjoy a competitive advantage that should lead to increased margin on Amazon.

Fulfillment by Amazon

Fulfillment by Amazon (FBA) is not necessarily a different business model. However, it does have an impact on many of the economics Amazon sellers must consider.

In FBA, sellers put their products into Amazon’s network of fulfillment centers, and when a customer places an order, Amazon does the individual order fulfillment. These products are eligible for Amazon Prime and Amazon Super Saver Shipping. Both of these programs have been shown to increase customer conversion rates.

From an economic perspective, businesses need to weigh the potential savings in shipping and increases in sales with the lack of control over inventory.

Other Potential Costs Factors

Amazon has particular requirements for all sellers that can have an impact on their cost structure.

Many Amazon sellers see increases in customer service costs. Amazon requires that all sellers answer customer inquiries within 24 hours. The requirement applies to any day of the year.

Expedited shipping, feedback, ratings, optimization, and sponsored search are often new frontiers for many business owners. Outsourcing tasks that are unlikely to be a business’s strength is not only affordable but can be quite effective. Thousands of Amazon professionals are available for $5-$10 per hour through services like Freeeup, Upwork, and Lancer.

Lastly, under the FBA model, companies lose control over some of their inventory. For manufacturers, this is less of a concern. We won’t dive into this issue, but do know that if you are considering FBA, additional research needs to be done.

Unit Level Economics

Selling on Amazon can be an immensely profitable channel for brands. However, just like any other sales channel, a business needs to understand its true profitability.

Choose an Amazon Selling Plan

As of this writing, Amazon currently offers two selling plans.

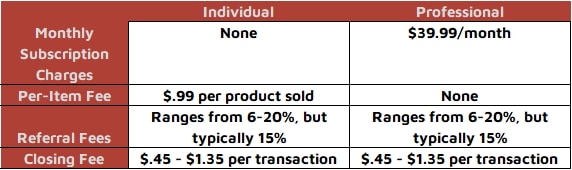

- Individual sellers pay $0.99 for each item sold on the marketplace, a referral fee, and variable closing fees ranging from $0.45 to $1.35.

- Professional sellers pay variable closing fees and referral fee percentages. Professional sellers also pay $39.99 per month, but they are exempt from the $0.99 per item fee.

Essentially, if you plan on selling more than 40 units per month, the professional plan is the way to go. I mentioned we wouldn’t go into the selling and marketing aspect in this article. However, the professional plan also gives your marketing team some resources to help drive sales.

Let’s break down the four charges that we have already encountered in picking an Amazon Selling Plan:

It is important to note there is a minimum referral fee, which is typically $1-$2.

The last amount Amazon will charge is the fulfillment fee. This fee is essentially shipping and handling to send your product out. A business won’t be charged if they handle their shipping. Amazon’s fee is typically $2.50 – $10.00 for most products.

Shipping is a hard cost to solve for in this equation. If a business chooses to go the FBA route, they will still have shipping costs for getting the product to Amazon. However, once there, Amazon enjoys much more cost-advantageous shipping than most other businesses. There is a shipping calculator available on Amazons site for business owners to consult.

It is important to note that the more advanced a business gest in their e-commerce sales channels, the more shipping overall becomes a factor. It is a significant cost. So much so that businesses need to make packaging decisions the contemplate potential shipping costs.

Those are the basic costs to sell on Amazon. However, if you choose to advertise on Amazon, there are more costs (and sometimes significant). When brands first start to advertise on Amazon, there is a period to pass before computing your average cost per sale. However, this is a unit-level cost that must be factored in.

Non-Amazon Costs

Too many businesses struggle to understand their internal unit-level costs and how it factors into profitability on Amazon.

Direct costs are the costs of the item a business is selling on Amazon. For instance, if a business purchased 100 shoes for $4000 + $325 shipping, their direct cost per unit would be $43.25.

Indirect costs are essentially on non-direct costs. These include costs such as rent, utilities, overhead labor, benefits, payroll taxes, travel, marketing, web development, and all other costs it takes to run a business.

These costs can be determined by adding them all up over 12 months and then dividing by the number of units sold over that period. This is a simplistic way to measure indirect costs per unit, but it is a good starting point for businesses with a hanful of SKUs. There are other ways to measure this cost, but for most businesses starting on e-commerce, this method is more than enough.

This calculation should be redone at least quarterly to ensure the cost structure hasn’t materially altered.

Return costs are the costs associated with inventory that is returned to the seller. Does this inventory need to be written off, what are the costs to replace, and lastly, can you resell this inventory.

Fulfillment fees only need to be calculated internally if a business is fulfilling product orders.

Lastly, profit must be considered. A business doesn’t want just to cover its costs. It should desire to make a profit. As you’ll see below, we want to set a minimum profit percentage acceptable to the business.

If a business doesn’t have a constant pulse on profitability by SKU, it can be challenging to make the necessary changes to vendor negotiations, inventory management, or product sourcing decisions needed. By having this knowledge, a business can then price their products appropriately on Amazon.

Example

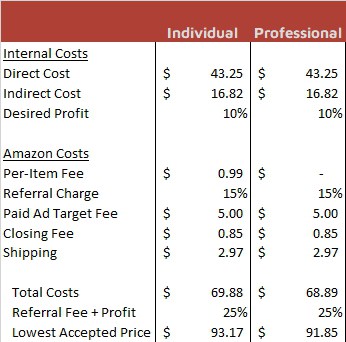

Let’s continue to walk through our shoe example from above. If you remember, the Perfect Shoe purchased 100 pairs of a line of shoes for $4,000 + $325 shipping. The direct cost per unit for these shoes would be $43.25.

In the past 12 months, The Perfect Shoe has total indirect costs of $185,000. Over that same period, they sold 11,000 pairs of shoes. Their indirect unit cost is $16.82.

The owner of this shoe store desires to have a minimum profit of 10% each year. Amazon will be doing the fulfillment, so there is not a separate shipping cost to be considered.

Lastly, The Perfect Show does paid ads on the Amazon site. Their target cost per sale is $5.00.

Now let’s put this into a spreadsheet to get our pricing for this SKU –

For this particular SKU, The Perfect Shoe must sell them for either $93.17 or $91.85 (depends on the Amazon plan) to achieve their desired profit.

Think about how powerful this is. If there are like products selling on Amazon for $99, they can now price theirs at $94 and know they are making more profit than their goal. This business also knows that if a similar product is selling for $79, they most likely either shouldn’t sell the product, or they need to make adjustments to their cost structure.

Final Thought

The exercise we went through today is the perfect example of what a “smart” business is doing. Opening up new sales channels is always hard. It’s OK to dabble before fully committing. However, no matter the plan, a “smart” business knows its economics.

About Krieger Analytics

My name is Matt Krieger, and I am the founder of Krieger Analytics. We are a virtual CFO and bookkeeping services partner for small businesses and franchisors. Our goal is to completely outsource your accounting department from bookkeeping to virtual CFO services. I am also the owner and franchisor of a concept called Monkey Bizness, in Denver, Colorado. I know what running a business entails.

As a small business owner with a finance and strategy background, I realized the benefits that a virtual CFO could bring to smaller organizations. Most franchisors and small business owners don’t have a need (or budget) for a full-time CFO or bookkeeper. To better fit my clients, Krieger Analytics is a part-time resource. While most think of CFO’s being involved in finance and accounting (we are), we are also involved in much more. We partner with clients by coaching, giving them clarity into their business, and creating growth strategies. Conversations are free, so don’t hesitate to reach out to me at [email protected].