How far would you get into a road trip without your speedometer, gas gauge, map, or GPS? Likely not very far. So why are you still running your small business without a financial dashboard? I am not the first person to equate the financial dashboard to the dashboard of a car, but it is a surprisingly useful metaphor.

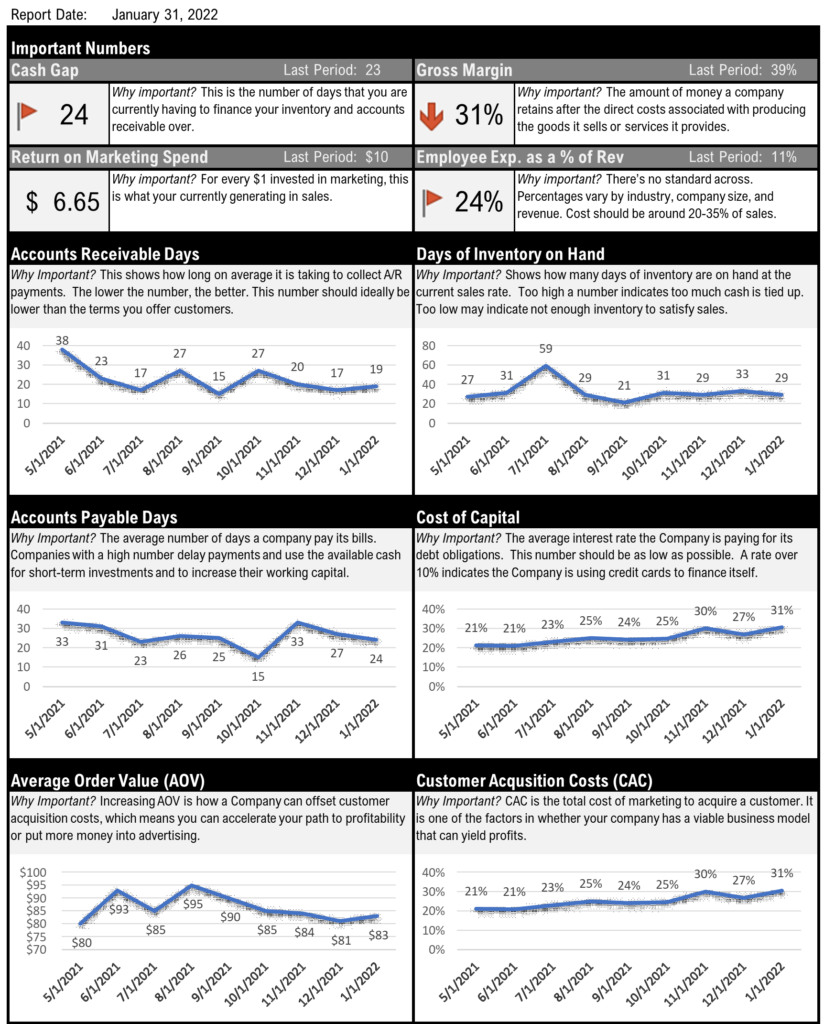

Your financial dashboard is a graphic page of your business’s key performance indicators (KPIs). It tells you how your business is performing in real-time. Businesses of every size are transitioning toward financial dashboards so they can get a bitesized update of their business on a timely basis.

Small business owners often think that financial dashboards are too much to invest in or take too much time to create. The reality is that small businesses need financial dashboards as much if not more than large businesses. When you are a small business, the line between success and failure is thin. You need to do everything you can to make sure your business is on the right side of that line.

In this article, I will discuss why a dashboard and scorecard are essential for small business owners and entrepreneurs. Getting a report on the financial health of your business will help you track cash flow, expenses, debt, and more.

Financial Dashboards for Small Business

Many businesses fall into the trap of thinking that because they spend so much time in their business, they know everything they need to about their company’s strategy. Unfortunately, research shows that only 5% of small business owners and employees understand their company’s strategy.

So how can you beat that statistic and make sure that your employees are on the same page with you? Scorecards and dashboards are effective strategic management systems that helps you keep track of your business. Beyond this, it is a performance measurement system that tracks workload and a tool that helps your team communicate ideas and needs.

Both financial dashboards and financial scorecards are essential components of a small business. The scorecard can focus on work project by project while the financial dashboard gives an overall summary of key performance indicators.

Financial Dashboards Needs

Now, let’s talk about financial dashboards. If you, like many other small businesses, don’t have a financial dashboard you might be wondering where to start. There are five traits that all good financial dashboards share. You should look for these traits when you develop your company’s financial dashboard.

Current

The most essential trait of a good dashboard is its timeliness. Your dashboard absolutely must be able to use the most current data from your company. Remember, the dashboard is all about getting a snapshot of the company in that specific moment. Using old, out-of-date data can hinder the effectiveness of your dashboard. Further, using stale data could lead you down a path of making the wrong decisions.

Actionable

Your dashboard must highlight KPIs that are easy for you and your team to understand and act upon. Your dashboard is a tool to help you make quick, simple adjustments on the fly. The KPIs you choose for your dashboard should spark questions when you see them and inspire you to dig further into the data and see new patterns. Too often business owners will pick KPIs that are not impactful or don’t give leaders actionable data. When deciding on KPIs, think about how a chance in a given metric would impact your actions.

Intuitive

Your dashboard, like the dashboard in your car, needs to be simple to understand. You should aim to check the dashboard as frequently as possible, spending as little time as possible with each check. Therefore, it needs to have simple graphics and metrics that are intuitive. When it comes to analyzing these graphics and determining which dashboard will be best for your company, think about building a dashboard that says as much as possible with as little text as possible.

Custom

No two businesses are exactly alike, and so no two businesses’ dashboards should be the same. If you are using an outsourced CFO, find one that will help you create a custom business dashboard that serves your company’s particular needs. Remember, all companies have slightly different combinations of KPIs that are meaningful to their staff. Figure out which KPIs are best for your company.

Data-Based

Of course, your dashboard information should be based on data, but beyond that, it should be using the data well. Great business dashboards are able to create graphics with the most recent data and require very little prompting for updates. If you find that your dashboard is lagging, you should rethink it to make sure that you are making your decisions based on the most recent data available.

Small Business Benefits

There are lots of myths around financial scorecards and dashboards in the small business world. Lots of small business owners think of these financial tools as frivolous and not necessary for running a small business. However, there are many specific benefits that small businesses can get from using financial scorecards and dashboards to keep track of their business’s KPIs.

Quick Growth

Business owners who use financial scorecards and dashboards are able to adapt their business quickly. These tools also accelerate growth because they help companies see clearly when certain investments are not working.

Taking Advantage of Opportunities

Small businesses also love financial scorecards and dashboards because they are a great way to see when a business or team has met a significant goal. All great business strategy is centered upon goals and initiatives Using a dashboard a company can quickly track their progress and readjusted or pivot when needed.

Giving the Right Guidance

Team leaders have access to a continuous flow of information about their team’s accomplishments and shortfalls. The team leaders are able to give small bits of specific guidance to their team rather than waiting for a big mistake to give all of the guidance at once. Most employees prefer to have a little feedback frequently, sprinkled into the conversation, rather than one large meeting with significant feedback that you want to give for the quarter.

Organizing the Most Relevant Information

It’s surprising how much time you can waste when you are sorting through folders of spreadsheets to determine one important metric. With a dashboard, you can have all of the information you need in one place. Further, you have a designed system to gather data quickly so that you can update your KPIs.

Facilitating Team Participation in Strategizing

If two heads are better than one, then having all of your team’s heads on strategy is best. When your whole team can see how the company is performing, everyone has more chances to contribute their ideas.

Monitor Workloads

Observing your team in real-time helps you see where team members are struggling to keep up with their workload. This can help you determine when you need to hire extra help before you are in dire straits and your team is swamped with work.

Small Business Financial Dashboard Considerations

Dashboards typically are divided up by functional areas of the business. While every business is unique, they all typically have the same three functional areas: finance, sales/marketing, and operations. A financial dashboard should reflect metrics around each of these functional areas.

Sales and marketing metrics

Using our car metaphor, sales and marketing is the gas you put in your car. You need sales to make your business go. Your dashboard needs to have a set of metrics that represent the work that your sales and marketing team is doing to find new prospects and turn those prospects into customers. Here are some examples of metrics:

- Close Ratio

- Return on Marketing Dollar Spent

- Prospects in Funnel

- Leads

- Return on Ad Spend (ROAS)

- Customer Acquisition Cost (CAC)

Operations metrics

Operations are how you service your customers. Some companies perform a service. Other companies manufacture a product. For all businesses, operations typically include some sort of labor or employee management. Here are some examples of metrics:

- Utilization

- Widgets produced over a period of time

- Waste

- Labor or materials as a percentage of revenue

- Downtime

- Customer satisfaction

Finance metrics

There are tons of metrics around the financial statements that can gauge the health of your organization. The key is to pick ones that actually ate material for your organization. For instance, for a service organization that doesn’t require many assets, a metric such as return on assets would not tell much about the company.

For all businesses, I do recommend cash flow metrics. More businesses close because they run out of cash than for any other reason. This is why I typically always include days outstanding in payables, receivables, and inventory (which combined equal cash gap) for every company. Other examples of metrics include:

- Return on investment

- Sales by channel

- Current or quick ratio

- Gross margin

How to develop a financial dashboard

You have a scorecard, but you’re not sure if it is the best reflection of what your business is achieving. Are there ways that you can change your business scorecard to make it a better reflection of your business?

Shift Your Mindset

When you are developing your financial scorecard, you always want to lead with your goals. Make sure that your goals are prominently displayed on the scorecard. Think about ways to promote your team to have a better mindset. Create weekly mindset checks where you focus on the drivers that are actually pushing your success. If you can spot patterns and problems early and proactively push the needle on your goals, months will take care of themselves.

Understand the Difference Between Lagging and Leading Indicators

Lagging indicators can be an issue because of their reliance on the present moment. Don’t put too much focus on lagging indicators because they will not be an accurate image of how your company is doing now. Leading indicators are what you should use to help guide your business in the present moment and seize the day.

Other Articles

Did you enjoy this article? Here are some others to check out.

- 4 Metrics Any Business Owner Should Review Monthly

- The Essential KPIs Your Small Business Should be Tracking

- Big Ideas for Small Businesses: 4 Examples of KPIs Your Business Should Be Tracking

Conclusion

Getting a financial scorecard and financial dashboard for your small business might seem like a small step or even a frivolous investment but they can make a huge difference. Properly tracking performance in your small business will allow you to address problems before they become significant and even make staffing decisions before the situation becomes dire.

If all of this seems daunting to you, you’re not alone. Many small businesses feel overwhelmed by financial reporting decisions. That is why Krieger Analytics exists. We offer virtual, short-term CFO services to our clients so that they have support while they make big financial decisions for their companies. Many small businesses just need a little boost to get on the right financial footing, and that’s what we’re here for.

Don’t wait, contact us now!