According to the Small Business Administration, 70% of businesses are owned and operated by sole proprietors. While that is a huge percentage, it still leaves a 3 in 10 chance that your business will have more than one owner. It’s almost impossible to say how many of these non-sole owner businesses started out with one owner and eventually brought on an investor or partner. However, it is a common enough occurrence that as a business owner, you better off being prepared for a potential investor or partner.

As a small business owner, you are at somewhat of a disadvantage. While there is a huge market of skilled professionals willing to help owners of medium to large businesses find and structure such transactions, that market doesn’t exist for small business owners. In reality, most small business owners have a friend, family, or former colleague they would like to bring into their business as a partner or investor. In such a scenario, a small business owner is usually left to rely on what little experience their attorney or accountant might have.

Before even getting to that stage, the small business owner has often had discussions with their potential investor or partner about how a transaction might look. They have often discussed ballpark figures and potential roles each party would have after the transaction. This article is meant to help the small business owner prior to ever engaging in that conversation. By having contemplated just a few items discussed in this article, they will be better prepared to make a deal.

- Where is the invested money going?

The invested money can really only go two places – into the business or to the small business owner. Let me further explain….

I was talking with a small business owner who was telling me they would be bringing on a partner. While we didn’t get into much detail, he did mention that the investor would be paying him directly and he was wondering about the tax treatment. Let me further explain….let’s call our small business owner Fred and our investor Maggie. Fred currently owns 100% of Company A and wishes to sell Maggie a portion of Company A. Instead of having Maggie directly invest in Company A, she will pay Fred a certain dollar amount for some of Fred’s interest in the entity. In this instance, Fred will receive the funds personally and need to recognize a taxable gain for the transactions (this article is not going into the different tax scenarios, that would require a book).

How else could this be accomplished? Instead, Fred could have Maggie invest directly into Company A and the money would flow into the business. This would not be a taxable event for Fred. Company A would receive the cash and be able to put it to use in the normal operations of the business. Fred’s basis in the business would not be altered at all and Maggie’s interest would most likely be equal to her investment.

One might say both accomplish the same result…and they would be wrong. In our second scenario, the business has additional funds to use as it sees fit. In the first scenario, Fred receives the funds outside of the business. Neither scenario is right or wrong, but they are different and should be discussed (and somewhat tie into item #4 we’ll discuss later).

- Do I need to get a valuation of my business?

The short answer to this is yes…the long answer is still probably yes. There are two problems with business valuations. First, the more practical issue with them is they are expensive. To obtain a business valuation from an accredited authority can run thousands of dollars. Even if you go this route, you run into the second issue which is that valuations of small businesses are often more art than science. In other words, what one person tells you your business is worth might be drastically different then what another person says. What both say may be drastically different altogether from what you could sell your business for.

To complicate things, the models and inputs a valuation professional uses to value a business often shouldn’t be applied to small businesses. For instance, if your business makes $2 million each year in sales, should it be compared to a business that makes $20 million or $200 million each year in sales? The answer is obviously no, but some in some valuation models your business is being compared to those and other companies that may be much larger.

Let’s change our thinking when it comes to valuations. Instead of a valuation being one number that your business is worth, let’s think of a valuation as the range that your business is most likely worth. When a small business owner shifts their mindset to this line of thinking, a valuation becomes much more practical and useful. A valuation also becomes much more accurate.

While there are professionals that are accredited in business valuations, a CPA or accountant should be able to give you a valuation within this definition. This would be my recommendation for the small business owner. Discuss with your accountant a valuation. The accountant will most likely be able to give you a range your business is worth and discuss the factors that went into determining that range. If you don’t’ agree with the range, at least you know the methodology behind it. Further, it will save you thousands of dollars.

There will be some out there that warn you that not getting a valuation could lead to you leaving thousands of dollars on the table when it comes to bringing in a partner or investor. While this could be true, it is most likely over-exaggerated. The fact is these valuation specialists have little idea what your business is actually worth on the open market. While they can theorize what it should be worth based on several different factors, they really have no idea what it would fetch if it were sold tomorrow.

You should have an idea of what your business is worth (or a range of what your business is worth) prior to going into any transaction. But don’t think you need to spend thousands of dollars to get that idea.

- Are you prepared to adjust how you do business?

Most sole propitiators I know are running personal expenses through their business. This might be an automobile they also use personally or Starbucks runs every morning they believe are “business” related. Nevertheless, bringing on an investor or partner means you will need to alter this behavior.

All partnership agreements are different, but generally, distributions are done based on ownership percentages. That means that if Owner “A” owns 80% of the company, he gets 80% of the distributions. What generally happens is Owner “A” has a personal expense out of the company and forgets that it is actually a distribution. Let’s say Owner “A” accidentally uses their business card to purchase a new TV from Amazon for $800. Since Owner “A” only owns 80% of the business, the company now needs to make a $200 distribution to the other members/partners.

What I find in working with business owners is this is not a huge issue, but it is an adjustment that needs to be made at the beginning of any new partnership.

- Post-Money vs. Pre-Money Valuation

You and your new partner will need to agree on the valuation of your business. One determination that must be made is if this valuation is pre-money or post-money.

Pre-money valuation refers to the value of a company not including the new investment. Pre-money is best described as how much a business might be worth before it begins to receive any investments into the company. This valuation doesn’t just give investors an idea of the current value of the business, but it also provides the value of each issued share.

On the other hand, post-money refers to how much the company is worth after it receives the money and investments into it. Post-money valuation includes outside financing or the latest investment. It is important to know which is being referred to, as they are critical concepts in the valuation of any company.

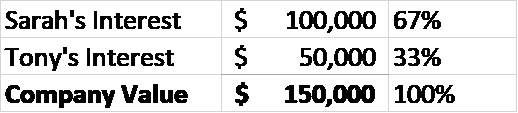

Let’s explain the difference through an example. Sarah owns a small business and is looking to bring on Tony as a new partner. Sarah and Tony agree that the business is worth $100,000 and Tony will invest $50,000.

The amount of ownership Tony receives for his investment will depend on whether the $100,000 valuation is pre-money or post-money.

Pre-Money Valuation

Post-Money Valuation

As you can see, whether the valuation is pre-money or post-money will have a large difference in the ownership shares of the two partners.

The difference between pre-money and post-money gets very important in situations where an entrepreneur has a good idea but few assets or operations. In such cases, it’s very hard to determine what the company is actually worth, and valuation becomes a subject of negotiation between the business owner and the potential new partner/investor.

- The Legal Side of a Transaction

While smaller businesses can often get to an agreement much faster and quicker than their larger counterparts, lawyers will still need to be involved.

At a minimum, there will need to be a new entity document drawn up. This most likely means a partnership agreement, articles of incorporation, or LLC agreement. Each of these documents will spell out how gains, losses, and distributions are allocated among partners. There are many instances in which these may be allocated differently than ownership percentages. These documents essentially set the “rules” for the business that all parties must operate under.

This is an important step because most start-up businesses are formed as “pass-through” entities and as such, are generally accounted for as a “Schedule C” entity for the owner’s taxes. This will change and it is important to think through potential advantages and pitfalls for all owners before selecting a new entity for the business.

Depending on which state the entity is registered in, there are often documents that need to be filed with the secretary of state. If the taxation of the entity is changing, then there are documents that will need to be filed with the Internal Revenue Service.

While small business owners can drastically reduce the transactions costs by consulting with their lawyer, accountant, and tax professional upfront, they also must be reasonable when it comes to determining how to best use their professional team. While it may be painful to pay that extra thousand dollars today for consulting, when it is saving you from a lawsuit or thousands of dollars in taxes down the road, you will be glad you did.

Ready for a Partner?!?!

Bringing in an investor or partner to your business will be challenging. However, the more you can prepare for it, the easier the transaction and transition will go. By understanding just the five items above, you will already be light years ahead of where many small business owners are in this process.

Investors, whether personal acquaintances or third parties are looking for businesses that are profitable and well run. Nothing scares off an investor faster than if an owner can’t articulate why their business is valuable. Further, the more a small business owner can spell out how a potential transaction would look, the more likely they can dictate the terms. A little thought and planning can lead to a much more desirable outcome.

Krieger Analytics is a unique accounting practice that is looking to provide financial clarity for the business owner so they can accomplish their goals. We aren’t the typical accountant as we want to provide a high, more comprehensive level of service to you. We help you understand your past results and plan more for the future. Unlike most accountants, I am also a small business owner so I understand the issues you are dealing with. If you would like to discuss your business and see if we may be the right solution, contact us now.